Urban Water Strategic Management in 21st Century(II)

| 论文类型 | 基础研究 | 发表日期 | 1999-09-01 |

| 作者 | Wei,Yan | ||

| 摘要 | Urban Water Strategic Management in 21st Century[II] 4. FINANCING OF WATER SERVICES UTILITIES IN OVERSEAS COUNTRIES 4.1 GENERAL Financing of capital works by means of borrowing is often necess | ||

Urban Water Strategic Management in 21st Century[II]

4. FINANCING OF WATER SERVICES UTILITIES IN OVERSEAS COUNTRIES

4.1 GENERAL

Financing of capital works by means of borrowing is often necessary because works need to be constructed in advance of their use. The borrowing allows the facilities to be paid for while they are being used. This approach is considered by many to be the fairest way of providing capital facilities. Others prefer to keep borrowing to a minimum and attempt to pay for works out of current resources. This is often possible for smaller capital projects but becomes difficult for major projects.

In jurisdictions where the national government does not have authority over local water authorities, such as in North America, influence over local water supply authorities can be achieved through mandatory service standards such as for drinking water quality. Conditional grants and subsidies can also used to control the provision of local services. It should be noted that capital construction grants by senior government levels are common and have a powerful influence on the extent and type of capital construction.

In recent years, there has been a trend in many countries to let market forces prevail. In addition, grant levels appear to be decreasing. However, senior government authorities and bank lending institutions continue to use grants and subsidies to encourage policy objectives.

It should be noted that borrowing is not a revenue source, but merely a financing tool. It only defers the time when revenues must be generated to pay for the capital investments.

The percentage of capital investments for a utility, which are financed by grants, is a measure of the extent to which the utility is a drain on the government in terms of subsidies. Any utility generally serving a city of more than one million population should not have to rely on any grant financing, but instead, finance from own sources, government loans, commercial loans or local authority bonds. Out of 50 utilities in Asian and Pacific Region, all governmental grant financing is utilized by 10 utilities and no grant financing by 19 utilities. Manila is an example of the use of local authority bonds. Seoul, Vientiane, Bangkok and Kuala Lumpur use commercial financing.

The governments at different levels and public corporations financed most infrastructure in Japan. Government policy and financial regulation guided private investment. The diversified configuration of financing allowed the Japanese government to play a pivotal role in sustaining infrastructure development and hence Japan‘s high rates of economic growth from the 1950s through the 1980s.

To alleviate the burden on general tax revenues, the Japanese government undertook several measures. Public corporations were created to collect user charges and issue corporate bonds to raise funds from public and private financial institutions. Major infrastructure projects were financed by establishing special accounts to collect user fees and earmarked taxes. Bond issuance for public works has since become an important financing instrument, especially during periods of general economic downturn.

A unique financing device is the Fiscal Investment and Loan Program (HILP). The HILP program channels funds collected from postal savings and social security pensions to public corporations and private investors as interest bearing loans. In this way, the government avoided to increase taxes and to expand private investment through government financial institutions. The program was intended to ensure accountability Since public corporations are liable to repay the loans plus interest, they have to pursue profitability and monitor direction, performance and efficiency of private investment in infrastructure. However, some public corporations failed to meet this accountability criterion, because certain types of infrastructure investment are simply unprofitable.

The recent policy argument is whether there still is need for strong government control over infrastructure financing to ensure achievement of the country‘s economic policy goals. The recent growth in private financing of construction and operation of certain types of infrastructure shows that Japan is reaching a more pragmatic stage in the configuration of financing. The ongoing administrative reforms at the various levels of the policymaking processes stress the importance of introducing market-based criteria in the construction of infrastructure without sacrificing the quality and coverage of infrastructure services.

In U.S., primary funding sources for government-owned and operated water utilities are revenues from rates and other fees and charges, issuance of debt and receipts from contributed capital in aid of construction.

In Denver Water, U.S., management prepare a capital project plan that shall identify all capital improvements likely to be needed during the next ten years to satisfy projected growth in demand for water and to maintain existing capacity to provide water. Each year the management will develop a ten-year financial plan, which incorporates projected revenues and expenditures included in the capital and O&M plans. The ten-year Financial Plan shall be used to develop one or more scenarios for financing projected expenditures. The long-term plan will incorporate the management‘s assumptions with respect to revenues, expenditures and changes to designated balances over a ten-year horizon. The assumptions will be evaluated each year as part of the long range planning and budget development process.

Water rates pay for operation and maintenance expenses, repair and capital replacements and improvements to existing facilities, debt service principal and interest. Capital expenditures for new facilities and water supply are funded from other non-rate sources of funds: system development charges, participation receipts, reimbursements, debt, reserves and other sources. System development charges which has provided a major source of funds for capital expenditures and front-end participation from developers and reimbursements.

In the guidelines for the use of debt, Denver Water confirmed its long-standing policy of using debt financing for system expansion and improvements and prohibiting its use for payment of operating and maintenance expenses.

4.2 CHARGES AND FEES

In U.K., regulations allow the Water Service Companies (WSEC) to recover infrastructure costs for the servicing of new customers. Connection charges can be used to recover the cost of the connection from a new customer‘s premises to the municipal water main which has historically been made by the water utility. Some WSECs apply a standard fixed charge, others charge the cost of the specific connection. There is a gradual movement towards the customer hiring a contractor to do the work under municipal inspection. It is thought that competition will decrease the cost of connections.

In the Province of Ontario, Canada‘s largest, there are legislated methods for recovering the capital cost for new development from the benefiting customers. Special charges can be used to recover the capital costs of facilities that are required to service new developments. These charges are differentiated by type of facility as follows:

- Capital Costs of Major Facilities - major facilities include water supply plants, reservoirs, pumping stations and trunk watermains to service new development. Costs of these facilities can be recovered by development charges that are levied against new developments. For example, there might be a charge of $2,000 per apartment to the builder of a new apartment building.

- Cost of Local Water Main - Where a municipality provides local services, a charge against the property can be used to recover the cost of providing the local watermain. This charge can follow one of the following formats:

a) A frontage rate on the lands that receive an immediate benefit from the work

b) A frontage rate on the lands that receive a deferred benefit from the work.

c) A hectarage rate on the designated lands,

d) A mill rate on the assessed value of the property.

e) A rate on the portion of the land that is connected to the sewage works based on the water rates charged.

Where private developers construct the local works, the cost is absorbed by the developer and no fee is paid to the municipality for local costs.

- Cost of the Service Pipes - the service pipe is the connection from the watermain to the customer‘s premises. The portion on public property, that is up to the property line, when built by the municipality, is paid for by the customer by means of a connection charge. If built by a developer, the cost would be passed on to the new customer in the price of the property. The portion of the service pipe that is on private property is entirely the responsibility of the property owner.

Another example to use user charge to pay for the capital cost is Denver Water‘s system development charges. System development charges are tap fees for new connections to the Denver Water System that represent a partial payment of capital costs to provide service from the necessary supply, storage and treatment facilities. Such charge is assessed upon application for a new tap and is based upon the size of connection required. This charge applies to any applicant who takes water through Denver Water‘s system directly and indirectly. Participation receipts are payments made by developers or districts for capacity in specific pumping, storage and transmission facilities that will serve their particular areas. These payments equal the actual cost to Denver Water of adding the capacity.

4.3 BOND

The Board of Water Commissioners, Denver Water is authorized by the local legislation to issue revenue bonds and general obligation bonds. The voters of Denver must approve issuance of bonds, unless the purpose of the bond is to refund a previously issued bond and the maturity does not exceed 50 years from the first use of the facility financed by the debt. The Board commits to pay principal and interest on any general obligation bonds from the revenues of the water department. The Board has made such a commitment for all bonds it has issued. The Board has a program of refunding a portion of the debt that matures during most calendar years. Additional amounts may also be refunded when market conditions are favorable.

The Board issued Certificates of Participation (COPs) which represent a right to receive rental revenues arising out of a lease agreement. This long-term lease agreement is treated as a capitalized for financial reporting purposes. The Board makes a decision annually whether to allocate funds for the lease payments, so certificate holders must rely on the importance of the leased facility to the Board‘s operations. Treatment plant, pumping station and reservoir were or will be financed by the use of COPs.

The long-standing current refunding program has enabled Denver Water to obtain a lower average cost of debt by making it possible to borrow at a shorter average maturity. Since facilities generally remain useful beyond the original maturity of debt issued to construct a facility, the refunding program has enabled to better match loans used to construct facilities to the lives of the facilities. Closer matching means that the cost of each facility is shared by all customers who will use the facility both present and future water customers. In addition, because one effect of the refunding program is to increase the funds available for current year capital requirements, the refunding program has also had the effect of reducing current year revenue requirements for capital projects. This has helped to avoid erratic fluctuations in rates and fees.

The Metropolitan Waterworks Authority (MWA) in Bankgok is a good example of a utility which allows it to obtain considerable capital financing from the local bond market. Singapore PUB and MWA exhibit strong leadership and management skills.

5. International Experiece on Cost Recovery

The approach used for the recovery of water system costs in Canada can be presented by the Province of Ontario, Canada. The Province of Ontario legislates the methods available for the recovery of the capital cost of providing water system infrastructure for new development. The Municipal Act, a law passed by the Province, sets out many of the regulations. For example, the following establishes the framework for recovering the cost of water system facilities that are constructed by the municipality: "Subject to the approval of the Municipal Board first being obtained, the council of a local municipality, in authorizing the construction of sewage works or water works, may by by-law provide for imposing upon owners or occupants of land who derive or will or may derive a benefit from the sewage works or water works a sewer rate or a water works rate, as the case may be, sufficient to pay for the whole or such portion or percentage of the capital cost of the works as the by-law may specify, and, with the like approval, such by-law may from time to time be amended or repealed." (Ontario Municipal Act, Chapter 302, Section 218 (2)).

Ongoing system costs are primarily recovered from user charges. OM&A costs that are the year-to-year costs for operating the water system. They are recovered from user charges. No borrowing for these costs is allowed. Much of the cost of providing capital facilities for new development is recovered by charges to the new development or, at times, by grants from senior government levels. The remaining costs for new development as well as the capital costs related to replacement and upgrading are recovered from user charges.

A national study in 1985found that 85% of water system costs were recovered from user fees with the balance coming from local taxes or government subsidies.

The Province does require that revenues be used for the purposes that they are charged. Thus water system revenues must be used for water systems. However, the formulation of user charges is left to the municipality. Municipalities formulate their local tariffs based on local priorities and attitudes. As a result, there are a variety of tariff structure formats in use.

In France, the water tariffs must cover all operating costs and most investment costs. The communes are responsible for the complete cost of operating and providing water and sewer services. The communes budget for water and sewer investment and operating costs. The investment costs may be financed by means of loans. The costs must be balanced by revenues from the sale of water and sewer charges.

The following is an example of the charges: (1) subscription fee covering a minimum volume of water use; (2) consumption charge for usage exceeding subscription charge volume allowance; (3) meter maintenance fee; (4) surcharge or tax related to capital investment costs; (5) sewage volumetric charge; (6) sewage fixed charge; (7) customer service pipe maintenance charge; (8) basin agency pollution control charge; (9) basin Agency water withdrawal charge; (10) value added tax added to the local charges.

Thus the water and sewer bill includes fixed and volumetric charges that fully recover the costs of water and sewer system costs. The volumetric charges have traditionally been of the declining block type. The bill also collects charge revenues on behalf of private utility contractors, the commune, the Regional Basin Agency and the central government.

Basin Agency charges are the source of funds for the Financial Basin Agencies. Financial Basin Agencies funds are generated by water withdrawal and effluent discharge charges added to customers‘ water and sewer bills. The money is funneled back to communes in the form of loans, grants and subsidies that normally vary in the range of 15% to 50% of capital costs. This approach allows the Financial Basin Agencies to redirect a portion of the funds raised to needy communes. Although the Basin Agency charges are relatively small part of the bills, perhaps 10%, they do accumulate to a significant amount in total.

Denver Water, U.S. funds major new projects for upgrades to treatment facilities and reuse of water through system development charges and debt issues. Future rate increases of less than one percent above the inflation rate are projected to be sufficient to fund normal operations, including repair and replacements of facilities and debt service.

The water works system is completely funded through rates, fees and charges for services provided by Denver Water. Although Denver Water is an enterprise fund, there are not transfers to or from the general fund of the City and county of Denver.

Water rates pay for operation and maintenance expenses, repair and capital replacements and improvements to existing facilities, debt service principal and interest. Capital expenditures for new facilities and water supply are funded from other non-rate sources of funds: System development Charges which has provided a major source of funds for capital expenditures and front-end participation from developers and reimbursements.

The Board of Water Commissioners is authorized by City Charter to set rates for water service. Since its inception, the Board has set rates at a level sufficient to service its debt and to meet its expenses of operation and maintenance. The Board continually reviews its structure of water rates, adjusting them as may be necessary to provide adequate levels of revenue. Rate increases are implemented from time to time in order to offset the impact of inflation and other operating financial requirements. . In view of the operational and capital needs of the system and the impact of inflation, the Board conducts ongoing rate studies to determine required rate levels.

In U.K., ompanies are entitled to levy an infrastructure charge for the first-time connection of a domestic premises to a public water main. Starting in 1989 WSECs were allowed to use the charge to recover local and major infrastructure costs. After consultation, Office of Water Services (OFWAT) concluded that such charges should be restricted to the cost of developing the local network.

The Waterworks Authority (MWA), Bangkok started earning profit from 1985 onwards because of operation improvement and tariffs increase. The operation improvement was obtained through leak repairs and pipe replacement, billing improvement and collection, operation computerization, staff training, connections and production metering. Tariffs pay for direct operation costs, depreciation and amortization, interests, provision for bad debts and loss on foreign exchange rates. Water tariff is approved by the MWA Board but the Cabinet has to be informed.

6. Review of Urban Water Financing in PRC

6.1 OVERVIEW

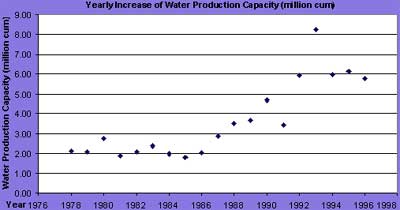

The water production in PRC has been rapidly increased since reforming beginning. Water production capacity increases from just over 2 million m3 per year before 1980 to around 6 million m3 per year in 1996. The maximum increase year was 1993 when 8.26 mullion m3 capacity was built up. Figure 6.1.1 shows the water production increase on yearly basis.

Total national and regional water production and sales statistics in 1996 are shown in Table 6.1. According to a survey of the industry in 1997 by the China Water Supply Association (CWSA), urban water supply services are provided by water supply companies (WSCs) in 558 cities. Total combined capacity of these WSCs is 103.9million m3/d. Total water sold was 22.1 billion m3 which consisted of industrial sales of 8.4 billion m3, domestic sales of 11.8 billion m3 and the rests of 1.9 billion m3. The leakage rate was 11.4 %. They provide water supply to 163 million persons representing 97.6% of the population within their service areas. The industry employs 270,700 persons. Although the sale revenue was 16.1 billion yuan, total loss from these WSCs were 0.7 billion yuan. Detailed are presented in Table 6.2.

The WSCs change during the period from 1986 to 1996 is shown in Table 6.3. The production of tap water grew at a annual rate of 9.8% from 1986 to 1996 while the service population, the total length of pipes and total production capacity have increased at annual rates of 7.1%, 7.5% and 9.0% respectively.

Figure 6.1 Yearly increase of water production capacity (million m3)

Table 6.1 National and regional water production in 1996

Province or Autonomous Region

Total annual water produced (103m3)

Source: Urban Statistics Book, 1997

Table6.2 Urban water supply in 1997

Item Unit Amount Water service population million 163 Water serverce rate % 97.6 Capacity million m3/d 103.9 Total water supply billion m3 27.3 Total water sold billion m3 22.1 among which, industrial water uses billion m3 8.4 domestic water uses billion m3 11.8 others billion m3 1.9 Water leakage billion m3 3.1 Leakage rate % 11.4 Sales revenue billion yuan 16.1 Profit billion yuan -0.7 Gross fixed asset billion yuan 70.8 Net fixed asset billion yuan 53.0 Staff person 270,700 Source: CWSA Statistics Yearbook, 1998Table 6.3 Water supply company in 1986-1996

Item 1986 1991 1996 Average Annual Change (%) Total Water Sales (109 m3) 13.1 17.9 26.0 9.8% Service Population (109) 95.3 131.7 159.8 7.1% Production Capacity (106 m3) 42.1 63.8 100.1 9.0% Total Length of Pipes (103 km) 52,272 73,439 107,817 7.5%

Source: CWSA “Urban Water Supply Statistics Yearbook,” various dates

Total employment in WSCs has increased from 146,100 persons in 1986 to 261,400 persons in 1996. This growth represents an average annual rate of increase of 6.0%. The labor force has not therefore grown as fast as production levels which is what to be expected in a capital intensive industry exhibiting some economies of scale in production.

In 1996, 29% of the total population was urbanized. The urban portion is expected to be 35% in 2000 and 45% in 2010. With every percentage point increase, the urban population increases by 12 million persons and the daily urban water demand increases by 2.52 million m3. From 1986 to 1990, the annual increase in urban water supply capacity was 8 million m3/d. From 1991 to 1996, the annual increase was 10 million m3/d. Daily capacity in 1996 was approximately 200 million m3 and it is expected to reach 258 million m3 by the year 2000 in order to meet growing demand.

The MOC and local governments have invested ¥30 billion from 1978 to 1993 years in water supply, while other branches of the Central Government have invested approximately ¥800 billion in water resources development over the same period.

6.2 LAWS AND REGULATIONS

The legislative authority in PRC is divided into two levels, central and local. At the central level, the National People‘s Congress and its standing committee exercise legislative authority to make state laws. The State Council is the administrative body of the Central government. It draws up state regulations that apply to all organizations and agencies within the PRC. The state ministries and commissions have the authority to draw up administrative regulations that apply to organizations and agencies within their own sphere of authority.

The "Water Law of the People‘s Republic of China" (the Water Law) took effect in 1988. It is a comprehensive statement of policy regarding water. The Water Law addresses water development and use, the protection of water resources, construction of projects for water management and use, the management of water uses and flood prevention and protection. It contains general rules, policies and supplementary provisions pertaining to these matters. The Water Law establishes the authority to impose legal sanctions for violations of regulations under the law, and it assigns the function of water resources planning and management to the State.

"Urban Water Supply Regulation" addresses the following subjects: water supply within the context of urban development, water resources used for urban water supply, construction of water supply facilities, management and operation of urban water supply systems, and facility maintenance.

National Guidelines on Water Tariffs (NGOWT) is a State regulation dealing specifically with water tariffs issued by the SDPC and the MOC in September 1998. Draft guidelines were prepared in 1996. The ADB has provided a technical assistance grant to the Government of PRC to assist the Government in the preparation of the draft NGOWT. The S.M. Group International Inc., Canada (SM) supported by Urban Water Resources Centers (UWRC), was contracted by ADB to provide the consulting services. A number of important features in these guidelines are indicative of the philosophy and general approach that is currently being pursued:

a) Guidelines apply to all urban water supply enterprises

b) The institutional structure provides for (i) unified leadership from the Central Government, (ii) formulation of strategies, policies and regulations by MOC and SDPC, (iii) delivery of policies and regulations by the construction and pricing departments of provincial governments and autonomous regions and cities, (iv) implementation of tariff methods and procedures at the municipal and prefecture level.

c) Principles to be applied in water supply pricing include: (i) benefits to the water supply utility are to be achieved, (ii) water conservation and water resource distribution benefits are to be realized, (iii) there should be adequate recovery of costs and reasonable profits for the water supply enterprise, (iv) consideration must be given to social burdens experienced throughout society.

d) Key elements proposed for water tariff design include: (i) customer metering, (ii) tariff review and adjustment, (iii) a two-system or two-part water tariff with a basic charge and a volumetric charge.

e) Tariffs calculations are to be based on costs and expenses that conform to established financial and accounting standards, applicable taxes and reasonable profits.

These draft guidelines also made provision for the implementation of policies and procedures for water tariffs. The MOC and the SDPC are directed to explain the new methodologies, while local agencies will establish the conditions required to put in place democratically and scientifically sound procedures for tariff calculations and explain and promote these to all groups within their communities.

6.3 PROFITABILITY OF WSCS

Aggregate sales for WSCs in 1996 were ¥13.7 billion on sales of 22.563 billion m3 of water. Overall, the industry experienced a modest profit of ¥0.044 billion or 0.1% on net assets. The profitability of WSCs indicates that 35% of WSCs failed to make a profit in 1996 and the performance of losers was bad enough to offset the net earnings of WSCs that made a profit. It became even worse in 1997 when the loss of 746 million yuan for the entire water supply industry (CWSA, 1998).

6.4 CAPITAL FINANCE

The major sources of financing for water supply capital projects include:

a) Government Grants and Equity Investments - Water supply infrastructure has often been financed out of government budgets. This practice continues but is being gradually replaced by a greater reliance on other sources.

b) Domestic Loans and bonds - Loans are provided by commercial banks at market based rates and by development banks which offer favorable lending terms. Funds at favorable terms are limited and development banks that specialize in commercial investments are becoming more cautious about high risk loans and may now require guarantees or collateral to secure loans.

c) Funds from User Charges - Charges such as facility construction fees on the water bill are used to collect capital funds.

d) Private Investors - Relatively new initiatives are seeking financing by means such as Joint ventures, BOT projects and concessionaire contracts and the purchase of bonds and stocks.

e) Multilateral Loans - Loans from institutions such as the World Bank Group and the ADB.

f) Bilateral Loans - Japan‘s Overseas Economic Cooperation Fund is the largest source of bilateral assistance. Australia, Canada, Germany, France, and Italy are other countries that have provided bilateral support. Loans are offered on concessional terms.

g) Bilateral Co-financing - bilateral government loan combined with a private loan. Shenyang WSC received used bilateral co-financing to secure loans of US$5 million from France. Of this amount, 42.5% is the bilateral loan with 2.5% interest and 30 year term; and 57.5% is the private loan with 8.3% interest and 13 year term.

6.5 PRIVATE PARTICIPATION

Foreign private sector participation in the water supply industry is still in an early stage of development. The first urban water supply BOT project is being developed in Chengdu. An agreement on the US$100 million project was signed in July, 1998. The project includes a 400,000 m3/d treatment plant and a 27 kilometer transmission pipeline. Construction is expected to begin early in 1999 and the year of commissioning is 2001. The contractor is responsible for financing, construction, operation and maintenance of the project, and will transfer the project without charge to the Chengdu government after the agreed term of 18 years including 30 months of construction time. Under the agreement, the Chengdu municipal government will purchase 400,000 m3 a day from the plant.

The two shareholder companies in Shanghai are publicly traded joint stock companies. The government of Shanghai is the majority shareholder of both companies. Its investment in these companies took the form of cash investments and contributed capital. The contributed capital comprised existing fixed assets of the WSC which were transferred to the joint stock company. One company is a raw water supply company and the other operates a water treatment plant. Both companies sell water to the Shanghai WSC. Following approval in 1992 for the first joint stock company proposal, Shanghai proceeded to establish the company using a standard corporate structure including a management team and a board of directors.

A joint-venture agreement between Sino-French and the Shenyang Water Company (SWC) was reached in 1995 to purchase, own and operate an existing 450,000 m3/d water treatment plant. The total investment was $29 million split between these two investors in kind and cash. Treated water from this plant is distributed by SWC‘s distribution system. The internal rate of return is around 14%, which is considered as the lower limit of what foreign investors might accept, particularly in this case that heavy equity injection. Thus water tariff between the joint-venture and SWC has to be agreed on yearly basis.

7. Financing Strategy for Water Services

7.1 MOBILIZATION OF FUNDING SOURCES

Insufficient funding has been identified as the major obstacle to be overcome and mobilizing funding sources is the solution. Local counter fund is the key for the project. It should be advanced projected and planned. The massive investments needed in infrastructure are too large to come from traditional sources that are the Central Government, provincial and municipal governments. The Central Government special bonds help investment in urban infrastructure, however, it is considered as short term measure. Financial resources from multilateral and bilateral assistance are limited and can not be expected to fill the gap to meet the growing need for basic urban infrastructure. Commercial bank loans become cautious to lend. Other funding sources must therefore be considered wherever possible.

Therefore funding resources development will be essential to provide the financing necessary for infrastructure development. Potential sources of funding include government, international loans, banks, bonds, user charges and private investor. Measures to collect funds for capital projects include

(1) further implementing tariff reforms and user charges to increase income from cost recovery and the retained earnings of public utilities;

(2) promoting enterprise bonds and encouraging domestic commercial loans. The domestic banks are looking for investment under the pressure of increasing saving deposit.

(3) developing domestic capital markets; Mobilization of domestic capital markets to provide financing, particularly in long term will be needed.

(4) utilizing the special funds provided by the Central Government through the special infrastructure bond issuing and borrowing funds from domestic banks;

(5) strengthening local revenue generation by restructuring tax revenue sharing and municipal finance;

(6) promotion of foreign direct investment through joint ventures, BOT and other arrangement; encouraging domestic private involvement and public-private partnerships;

(7) utilizing international financial institutional funds;

(8) considering to establishing special funds for specific sector since the market has plenty of funds. This special fund can be invested in specific sectors or projects.

As the results, funds from multiple sources are growing. An increasing portion of the alternative funding is expected to come from user charges and tariffs and private sector. The financial arrangements that are available depend on the level of development of the financial markets. International financing agencies promote private sector through the involvement in urban infrastructure projects. Although private investment such as BOT is often more expensive, it provides the fund for the needed project and also helps development of local economy. Considerable portion of capital investment is converted into salary and consumable goods. A local government should make its own policy to attract the private investors from overseas and domestically.

Bonds have great potential in raising funds. Local governments are not allowed to issue bonds. Instead enterprises enlarge their bond issues. Tax break to bond purchasers can also be considered to encourage bond sales. However, current bonds issued by entrepreneurs are often restricted by very short term repayment period, e.g., 3 years and starting paying from the first year. For many infrastructure projects, it has not completed construction within three years, thus no income generated by rendering services benefiting from the project while the project needs to pay back the debt. As the result, it could lead to the project that may borrow funds from other sources to pay back the bond debt. Longer term of repayment of bonds will help to alleviate the project from repayment burden during the non-income period. Enterprise bond should have relatively long repayment period.

Enterprise reform is encouraging institutional restructure and merger and acquisition. Funds can be raised by transforming of ownership to private. Many of these type investment can occur. Service contracts can also become possible. Leasing and Franchise and even full privatization can be considered to be opened to investors with respect to specific projects.

Establishing a water investment fund aiming at funds from domestic market. The increasing saving deposit at continuous lowing interest means there is strong trend that people have funds and look for investment opportunity. The investment fund guarantees the minimum return rate with the option that the return can be higher if the investment is performing well. In this way, the fund will be attractive to domestic investors. At present stock market is considered as too risky. Based on survey, about 88% people who had shares was at loss in 1998. The fund also offers an incentive option along with user charge that is a passive way in which users only pay it out and no return. And user charge often can not be collected before a project starts.

7.2 OPTIMAL USE OF FUNDS

7.2.1 MIXTURE OF FUNDS FROM VARIETY OF SOURCES

A mixture of funding sources should be devised which makes best use of the available funds, as well as the goal and endeavor of the lending institutions when financial options are available. Funding from multi-sources is more reliable and less risks in terms of fund supply. Financial planning should strive to minimize the cost of capital investments. The opportunity to control financial costs increases when access to a variety of funding sources is available, including sources of both debt and equity funds, that are competing openly for investment opportunities. In open and competitive financial markets, the competitive process will establish rational differentials between the costs of different sources of investment funds. Management of multi-source funds can be complicate and coordinate is required.

7.2.2 FUND RAISING

Insufficient local counterpart funds, particularly initial equity funds have been considered as one of the major problems that causes difficulty of borrowing loans, delaying of project approval and implementing. Thus initial equity fund raising is the first, essential step in the whole fund raising for a project. Funds which can be used as initial equity fund is restricted from all fund sources. Normally, funds from governmental sources can be used as an initial equity fund. If a project can get sufficient governmental fund to be used as an initial equity fund, which meets the requirement of minimum equity, it should use this initial equity fund as a base to raising funds such as bank loans to the amount required for the project. It should avoid waiting for financing entirely from the governments. The initial equity fund is small portion of the total funds required for the project. Although funds from governments are usually free of charge, it takes long time to complete the project which not only can not meet the needs of the services but also affects investment return and the project scale may be reduced due to limited governmental funds.

7.2.3 DURATION OF LOANS AND DEBT

Multilateral and bilateral financial institutions can provide long-term loans with preferential terms, whereas short-term loans are more readily available from domestic commercial banks. The enterprise bond has short maturity. The State policy banks such as the State Development Bank support specific types of development with preferential terms such as relatively long term. In general, these banks are selective on projects and seek rapid repayment in order to be able to finance other new development. A mixture of long-term and short-term can be considered to reduce the impact of repayment peak.

7.2.4 REPAYMENT

Water supply projects require large capital in order to deliver the service in a long period of time. Thus the initial capital costs are high and operation costs are relatively low. The repayment comes from income earned by selling of services. The tariff should be kept at the level higher enough to cover the repayment and all costs.

7.2.5 RISKS

Construction can have high risks of expenditure over-runs from factors such as unexpectedly delays of completion. Any delay may not only increase the cost of work but may also delay use of the facilities and, therefore, their ability to earn income from which to start repayment. The cost of finance from banks will be directly related to their perception of risks. This leads both the lender and borrower to favour using short-term funding for high-risk elements. Once the high-risk aspects have been covered, longer-term funds at lower interest rates could be obtained during facility operation. Foreign exchange is another risk factor. The financing of infrastructure should be carefully reviewed at present since external loan financing alone may not be the best or cheapest solution, especially when cost recovery and foreign exchange liabilities are taken into account.

International financial institutions have their own requirements which domestic loaners may not have. In many cases, process of a project where the international loan is involved taking a bit long time is not caused by the strict requirement of the international financial institutions, and instead often it is due to the domestic preparation. When the project where the international loan is involved, the domestic review and approval procedure become more strict and complicated since both domestic and international requirements need to be met. The review and approval are very important since it provides a sort of assurance for the project implementation. However, local governments may not get used to the current focusing points of the review and approval processes being on the project preparation, the domestic preparation takes pretty long time to get the approval. For example, a detailed financing plan including assured commitments from all involved parties is required, which seems to be difficult for local government to get.

7.2.6 INTEREST RATES

The Central Government has lowered interest rate many times since 1996, which results in the domestic interests are lower than the interest rates of international financial institutions. Particularly, the international financial loans from ADB and WB is not as favourable as the special bond of the Current Government since the bond interest rate is low and contains grant portion. Many municipal governments and agencies prefer the special bond funds and domestic loans to the international funds. As a result, it appears that in some places it would rather wait for the governmental special bonds than borrowing international funds. A consideration should be taken due to a number of reasons. First of all, fund requirement for water service development is far more than the amount that the special bonds can supply. The needed development has to have fund to be built up. Borrowing international loans can meet the fund requirement and demands of infrastructure services. Secondly, the domestic funds have relatively short term, usually 10 years are maximum and interest rates vary when the term is finished. International financial institutions have long term, usually more than 20 years with relatively stable interest rates during a term period. Water supply projects usually need large capital to have long term facilities in order to deliver long time services. Loans and debts are often repaid back during long period of time. Long term loans with stable interest rates has the advantage of predictable cost and may be low cost in long term. As the third reason, domestic loans are interested in return in short period of time and long term investment in urban infrastructure has difficult to attract domestic loans. Finally, investment in water supply promotes local economy. Based on survey, about 40 % of capital investment turn into salary and other consumable goods. Raising funds from international institutions to fill the gap of the special bonds and domestic loans is the approach to be taken in order to meet the requirement of water demand and promote economy.

7.2.7 FUND RAISING TIME

Fund raising time varies with funding sources. Careful assessment of the time required to raising funds helps to plan schedule and cost saving. When the project where the international loan is involved, the domestic review and approval procedure become more strict and complicated since both domestic and international requirements need to be met. In general, international financial institutions have their own requirements which domestic loaners may not have and use of international funds require additional approval from governments. In many cases, process of a project where the international loan is involved taking a bit longer time than domestic funds alone. However, in other cases, the long preparation time is not caused by the requirement of the international financial institutions, and instead often it is due to the domestic preparation such as incomplete preparation of domestic counterpart funds. The review and approval are very important since it provides a sort of assurance for the project implementation. However, local governments may not get used to the current focusing points of the review and approval processes being on the project preparation, the domestic preparation takes pretty long time to get the approval. For example, a detailed financing plan including assured commitments from all involved parties is required, which seems to be difficult for some local governments. Private investment from foreign sources may take even longer time since detail, strict investigation is general requirement from private investors. Funds from user charges also take long time to prepare as the result that collection special user charges for a specific project takes time to get governmental approval and funds are raised during a period of time.

7.3 INSTITUTIONAL AND REGULATORY

Strengthening regulating mechanism of water investment is required to improve investment performances, reduce risks, promote funding sources. Although the share of government financing becomes smaller and smaller, in most cases, governments make decision on investment in urban infrastructure services. Infrastructure enterprises or governmental agencies are still largely depending on subsidization. Since responsibility is not clear and constrain regulating mechanism is not valid, it results in seeking large project size and neglect investment return. Responsibility for investment results should be clear and related to decision makers.

Project legal entity responsibility system should be enhanced. Government and enterprise should be separated. The newly established project equity fund system is one of the important components for the project legal responsibility system. The project equity fund requirement would be able to prevent excessive project size, control investment scale and require project sponsors to share risks related to the decision of the investment. It expects to promote investment to be effective and efficient. It also tries to reduce the debt burden of a project company. Project equity should be clearly defined. Project investment decision making responsibility system also needs to be strengthened.

Pricing reform should be accelerated. Further adjusting prices are the need for cost recovery. Nation Guidelines on Water Tariffs (NGOWT) promulgated in September 1999 is the first national regulation in water supply and also in municipal services. The ADB made contribution to assist in formulating the important guidelines by offering technical assistance. By implementing the NGOWT nationwide, the water tariffs are expected to be adjusted at the level to recover cost. The ADB continues its effort on the water tariff reform by providing another technical assistance.

Regulations on private sector involvement should be established and improved. These regulations can be used for both international and domestic investors. Majority of public utilities are offered by either governmental agencies or state own enterprises. Enterprise reform also applies to them. Institutional restructure and merger and acquisition can occur and service contracts can also become possible.

7.4 FINANCIAL PLANNING

7.4.1 REQUIREMENT OF A STRATEGIC AND IMPLEMENTATION PLAN

Urban infrastructure planning has generally followed a supply-side approach based on major governmental plans including urban master plans and five year plans. This trend is now changing to improve the utilization of limited financial and other resources. There is a shift from a supply-side to a demand-management approach and greater emphasis is being placed on a more rigorous economic justification for urban infrastructure projects.

In PRC, urban master plan and five-year plan are considered as the most important and longest plans. An urban master plan concerns overall urban development and emphasizes urban structure. A five-year plan considers economic and social development with the urban infrastructure development as the essential condition to support the above development. Both master plan and five-year plan often have up to 15 year planning period. A sector plan considers development plan in its sector and related sectors.

These plans have targets for urban infrastructure development to be achieved by the end of the planning period but they do not have financing plans, finance sources, budget balances, and implementation procedure and schedules. In general, these plans are not detailed enough to provide guidance for implementation of water service improvements. There is a need for a WSC to have a long range strategic and implementation plan which incorporates goals and objectives set up by a master plan and a five year plan and demands that are the basis for setting priorities and determining future direction and takes actions required to implement tasks. This strategic and implementation plan can cover the same period of a master plan and is updated annually. The plan should have components of demand, financial management, capital, budget, implementing schedule. For the capital investment, a financing plan should also be prepared. Figure 4.5.1.1 shows the proposed implementation plan and procedure of a project development.

Figure 4.5.1.1 Proposed project planning

7.4.2 STRATEGIC AND IMPLEMENTATION PLAN

Under the guidance of master plan and five-year plan, an implementation program is necessary to take action to achieve the objectives set up by these plans. With urban master plan and five-year plan providing a general frame and sectoral plans dealing with individual sectors, a long range strategic and implementation plan provides a useful tool in guidance by identifying needs, assessing feasibility, preparing for investments and implementing priority projects to provide services for urban growth to ensure efficient utilization of water supply; to identify priority improvement project; to accelerate backlog implementation and to optimize priority investment. Prioritization of projects for investment must place greater emphasis on demands, financial and economic arguments. This includes improved efforts to achieve full cost recovery from the beneficiaries through user fees.

The prioritization investment strategy for the provision of water services is prepared based on assessment of current levels of facilities and services, future demand, implementation status of the existing plans, existing proposals and plans for improvement, economic development; review of potentials and constraints for development, environment and financial sources, and interventions by the government and external agencies. Assessment of project implementation with planned schedules will help to reveal risks and opportunities. A method to assist priority project selection can be used in order to allocate scarce financial sources. Prefeasibility studies will then be conducted for the prioritized projects. Great emphasis must be placed on financing plan and preparation of funds.

In summary the following is required when selecting a project:

- A comprehensive development plan and improvement program

- Priority investment components, and development should be based on priority needs

- An external consulting firm can provide assistance

- A project reasonability system (an enterprises and individual responsibility system)

- A financing plan (financing sources and share distribution, fund preparation)

- Equity from investors (minimum requirement of equity injection from investors)

- Decision makers are from government and enterprise

- Complete one project and put it into operation, generate revenue and profit which will be used for other projects.

7.4.3 FINANCING PLAN AND PREPARATION OF FUNDS

Financing plans and preparation of funds are one of the most important components in a project process. A financing plan for a prioritized project should be prepared prior to submitting a project proposal. The financing plan will consider potential funding sources, cost of financing, available time and repayment scheme. In the financial plan, sources of funds must be identified and potential sponsors must be contacted. Consider that local counterpart fund and equity fund are the most import part for the financing plan, the providers for the local counterpart fund and equity should plan and prepare their funds in advance in order to be able to supply their portion of capital and to raise funds from external sources. Since funds from governmental sources become less and less, funds from user charges are playing an important role. During a period of time, collection of user charges to accumulate the funds prior to starting a project is needed, which can also avoid significant impact due to imposing steep rate increase. When the sources of funds are preliminary determined and all involved bodies have basic understandings, a project can be considered viable and then the project proposal can be submitted to governments for approval. Finally, favored projects satisfying technical, environmental, financial, economic, and social objectives will be prepared to be implemented.

7.5 PROJECT FINANCING

Since 1996, domestic loan disbursement has been slow down since the domestic banks consider that there are not enough good projects to be invested. Some urban infrastructure projects have experienced from no return or low return to adequate return on investment. But many projects face difficulty to attract domestic investors although many municipal services such as water utilities have relatively constant income by provision of services. This sends a signal that the projects which the investors lack interest are not good investment due to the financial performance expected.

A water supply project may fail to reach the proposed financial return goal since (i) over forecast demand and estimate capacity requirement resulting that sale income can not achieve the proposed target; (ii) over estimate required capital causing cost increase, difficult to raise funds and implementing period prolonging; (iii) ineffective cost control; (iv) inappropriate pricing for the services. Over forecast demand is common, which perhaps is caused that it has been long time infrastructure facility development lagging behind the economic development and requirement; and a water project, especially a large project, takes long time to be approved and it is difficult to predict a project processing time and implementing time. Completion of the proposed project later than scheduled causes that actual demand may be higher the proposed one. Overestimate required capital is partially due to overestimate demand, other causes may be to have additional funds to cover some other expenses, e.g. operational loss and benefits, which is often the case if government grants are part of funding source; consider that senior governments may cut their proposed capital requirement based on needs of a project, if a project submits the exact required capital financial plan, after cutting by the senior governments, the remaining capital may not cover the capital required to complete the project, tendency of trying to obtain more governmental grants through increase of total cost estimation is also observed. The fast increasing cost particularly labor and associated benefits could impress public that the investment fund could be misused for labor. Tariffs in many cities can not generate sufficient revenue to cover costs.

It can be summarized that a good project which is able to obtain its proposed goals including financial return is the key to raise funds from investors. Improvement on the above mentioned situations, particularly avoiding enlarging unnecessary investment will make the project turn into an attractive project to domestic banks. It is relatively low cast to raise funds since the domestic interest rate is quite low at present. Water supply has characteristics that the services are essential to economic growth and living, so that demand is stable. As a result, the income by provision of the services is stable. A demand analysis is very important and needs to be carefully conducted. Water supply facilities should be constructed ahead of time of urban and economic development and requires relatively long time to complete, capacity to meet future demand is reasonable and sometime more economic. Consider the trend of industrial demand to be stable and total demand increase to be slow, insufficient fund sources, and large project needing more fund and time before generating income, building capacity to meet short term future demand and building capacity by phases are favourable.

7.6 USER CHARGES

User charges present a large source of funds and more important is that the funds raised from user charges are eligible to be used as project equity funds. Tariff adjustments and other charges are one of solutions to solve the problems of insufficient funds. Tariffs are required to be set to achieve the objective of full cost recovery in order to end reliance on governmental subsidies. Full cost recovery means the recovery of all financial costs associated with the provision of water including direct and indirect operating and maintenance costs, depreciation, taxes, interest on debt and a return on equity. Capital funds can be partially raised through user charges. Approval of user charges is often within the power of a local government authority.

The governments are reforming pricing in urban infrastructure. Although tariffs in sectors like water supply have fast increased, most of them still are not high enough to cover the cost. With the tariff reform that is ongoing and the National Guidelines on Water Tariffs (NGOWT) issued in 1998 and implementing the NGOWT, it is expected the water tariffs will gradually be adjusted to appropriate level to cover cost.

Urban Water Strategic Management in 21st Century[III]

论文搜索

月热点论文

论文投稿

很多时候您的文章总是无缘变成铅字。研究做到关键时,试验有了起色时,是不是想和同行探讨一下,工作中有了心得,您是不是很想与人分享,那么不要只是默默工作了,写下来吧!投稿时,请以附件形式发至 [email protected] ,请注明论文投稿。一旦采用,我们会为您增加100枚金币。